Temu's expansion into Australia is reshaping the eCommerce game

*This article is kindly contributed by StudioSpace agency, Arktic Fox.

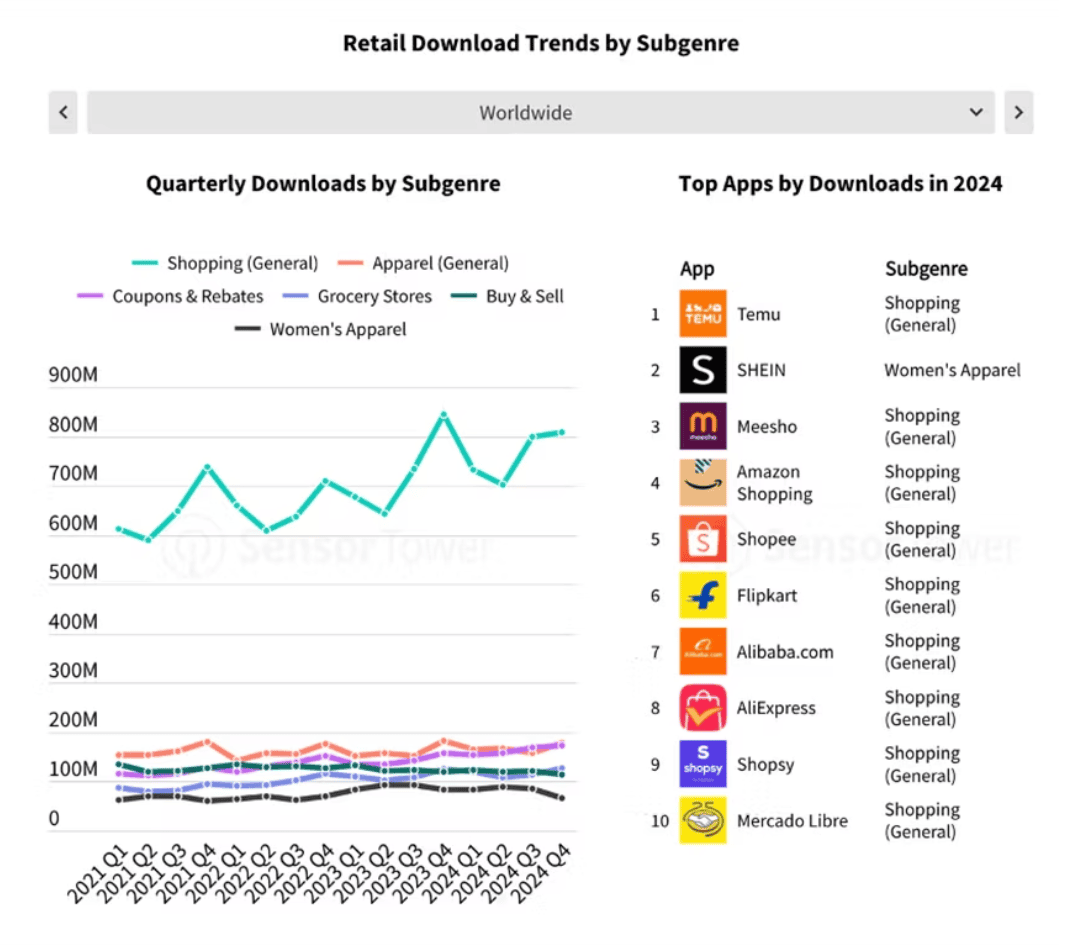

Temu’s arrival on Australian shores in late 2023 might have seemed, at first glance, like just another marketplace entering an already crowded space. But beneath the surface, something bigger has been brewing. In less than a year, Temu has rocketed up the download charts, ranking the most downloaded iPhone app for 2024 – in Australia AND globally - and the only shopping app to make the top 10 free apps list in Apple’s rankings, according to Power Retail.

Temu came top both in Australia and globally of app downloads in 2024

With its trademark cocktail of ultra-affordable pricing, an endless catalogue of products, and a relentless focus on deals, Temu rapidly gained traction amongst Australian consumers, helped by a cost-of-living crisis. According to NAB’s Consumer Sentiment Survey (April 2024), over 70% of Australians report being more price-conscious compared to the previous year. Timing, as they say, is everything, and Temu’s was spot on.

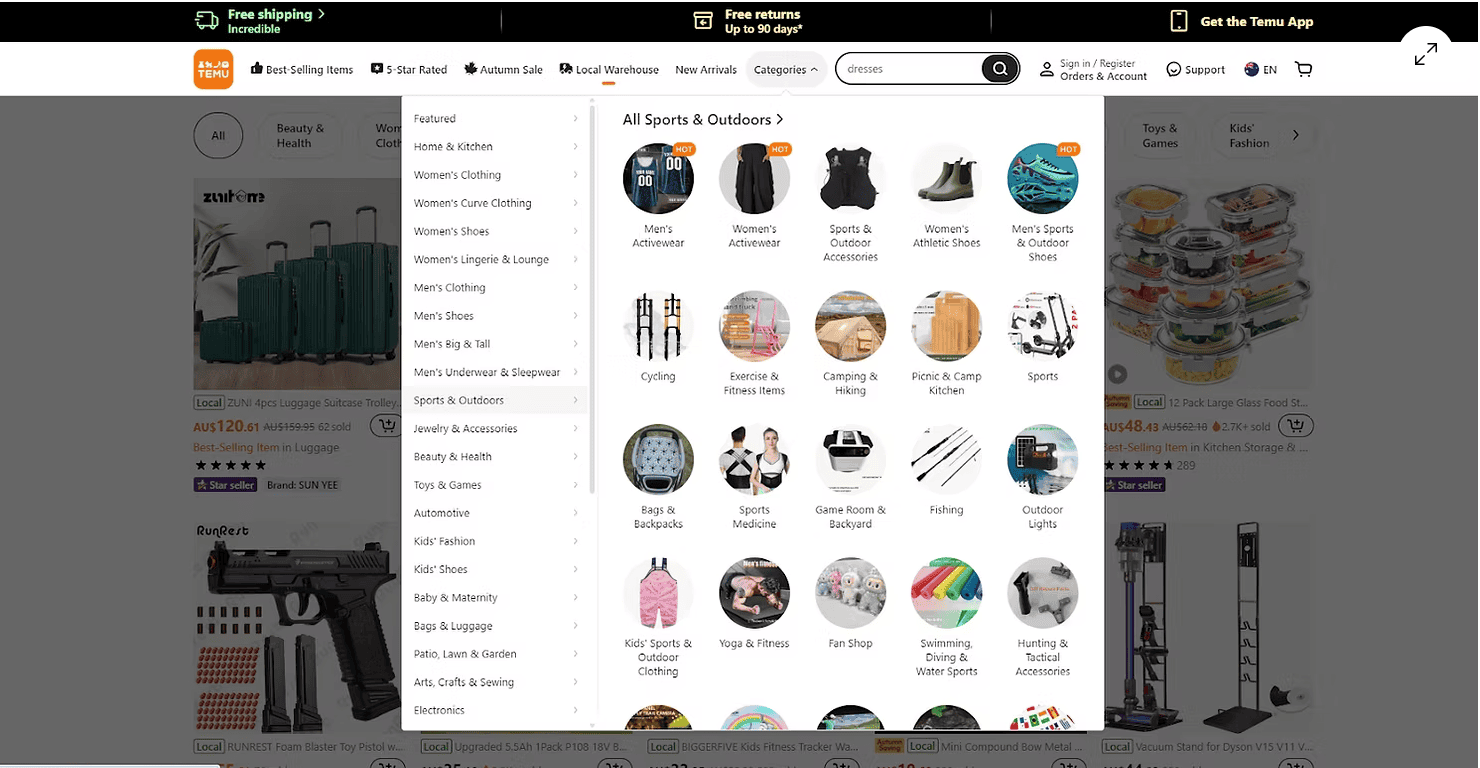

Now, the marketplace has announced it will allow Australian businesses to sell directly to local consumers through its platform, following the rollout of the same local-to-local model in more than a dozen markets, including the US, UK, Germany, France, Japan, and South Korea. For leaders in retail, eCommerce, and brand marketing, this isn’t just another channel expansion - it’s a significant reshaping of the competitive landscape.

This new offer is set to change the platform’s local relevance. Previously perceived primarily as a marketplace for cheap overseas goods (predominantly from China), the decision to onboard Australian sellers brings a new dimension to its model, blending local delivery speed and familiarity with the competitive prices Temu is known for.

###The power of Temu’s model and why it matters for brands

Temu’s success is anchored in two things: affordability and range. Its platform is designed to delight cost-conscious shoppers who are willing to forgo brand familiarity if the price is right. Brand loyalty in Australia is already under pressure, with research from Roy Morgan (March 2024) finding that 62% of Australian consumers say they are actively looking for cheaper alternatives across most shopping categories. It is particularly prevalent among younger demographics, with 64% of Gen Z saying they’d switch brands for better value or mission alignment (Morning Consult, 2024).

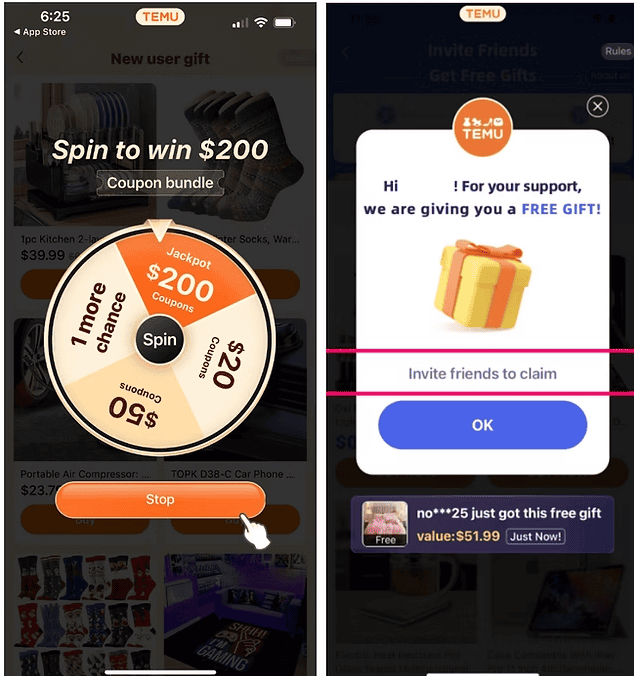

Affordability is driving decision-making at an unprecedented scale, but it’s not just about price. It’s about the perception of value: what you get, how fast you get it, and how seamless the experience is. Temu’s slick, gamified app experience, combined with prices often 30–70% lower than traditional retailers, makes it an irresistible proposition for a growing demographic of Australians.

But what does this mean for Australian brands and retailers?

Temu’s move to allow Australian sellers onto the platform presents an opportunity: an immediate, low-barrier-to-entry channel to reach a massive, price-sensitive audience. For small to medium-sized brands, especially those struggling with rising customer acquisition costs on Meta, TikTok, and Google, Temu could offer a ready-made alternative for scaling visibility. Early movers might enjoy first-mover advantages, gaining disproportionate share in a platform still establishing its Australian credibility.

Speed is another win. According to Australia Post’s 2025 Inside Australian Online Shopping report, most online shoppers expect parcel delivery within 2 to 5 days, with 66% saying slow delivery negatively impacts their likelihood to re-purchase. By investing heavily into logistics, Temu is setting itself up to overcome one of the few barriers it previously faced: long delivery times. While initial Temu orders often took 10–15 days to arrive from overseas warehouses, the onboarding of local sellers means that same-week or even next-day deliveries are becoming more achievable. Temu now has Australian fulfilment partnerships in Sydney and Melbourne, cutting average delivery times down to 4–6 days for many local orders. This puts it closer to Amazon’s standard delivery proposition - without needing Prime subscription fees.

- From Australia Post’s 2025 Inside Australian Online Shopping Report

However, while the upside for quick-moving brands is significant, the risks are equally clear. By joining Temu, businesses are entering a hyper-competitive environment where price wars are fierce, and differentiation is hard to sustain. Brands risk commoditising their products, becoming trapped in a race to the bottom on price and margin erosion. Equally unlike other marketplaces like Amazon, Temu sets the price of goods, which creates a set of new challenges for brands who are looking to take advantage of the platform – with price erosion and maintaining RRP a challenge in the Temu environment.

For brands, the question is not just about whether to sell on Temu - it’s about weighing up whether participation aligns with their brand positioning. Is Temu an opportunity to offload volume lines? A channel for price-sensitive SKUs? Or does it risk undermining premium positioning cultivated elsewhere? There are no easy answers - but opting out entirely may not be the answer either.

Competing in a Temu world

For mid-market brands, especially those in commoditised categories like fashion basics, homewares, and beauty accessories, the strategic challenge is pressing. If Temu’s offering feels “good enough” for everyday needs, consumers may increasingly reserve their brand loyalty only for purchases tied to stronger emotional or status-driven value propositions (think Nike trainers, Temu outfit).

There’s also a marketing and media strategy implication. Temu itself is a masterclass in performance marketing, flooding social feeds with shoppable ads, referral bonuses, and gamified incentives. It teaches consumers to expect promotions, coupons, discounts. Local brands will need to evolve how they engage consumers in an environment that is increasingly ‘deal-saturated’, and lean harder into first-party data strategies, loyalty innovation, and omni-channel journeys that create real stickiness.

Beyond consumer marketing, operational agility will also be a differentiator. Brands with fast-moving supply chains, dynamic pricing capabilities, and localised fulfilment models will be best positioned to thrive. We’re already seeing some players adapt: Cotton On, for example, recently announced enhancements to its click-and-collect infrastructure and free returns model, explicitly citing the need to compete more aggressively with global platforms (source: Inside Retail, April 2024).

Further investment in private labels, exclusive collaborations, and loyalty ecosystems may also be part of the defensive playbook as traditional retailers seek to hold ground against Temu’s growing share of wallet. Large players like Kmart and Target Australia are already doubling down trying to defend their low-price leadership by expanding range breadth and direct sourcing to maintain margin protection.

Meanwhile, Amazon is unlikely to sit still. Amazon Australia, which only recently reached profitability after years of investment, will likely accelerate its Prime loyalty benefits and local seller recruitment efforts in response. Watch for Amazon to double down on local fulfilment centres and possibly offer more attractive seller incentives to counter Temu’s momentum.

Number of app downloads in the US (appfigures.com)

Off the back of Temu’s local expansion and the growth of Amazon, we anticipate some of the following outcomes from retailers and brands alike:

Brands

→ Increased focus on DTC

We could see a shift | greater focus towards building owned direct-to-consumer channels as brands seek to regain control of margin, pricing, experience, and data.

→ Rise of hybrid models

More brands will adopt nuanced and hybrid approach to operating in the eCommerce space. This will be less about ‘do we operate within a channel or not’, and more about ‘what is the role of that channel within our broader eCommerce channel strategy’?

→ Product portfolio evolution

As channels grow, like marketplaces, it gives rise to the evolution of product portfolios where we see the introduction of new products, bundles and solutions that meet different user needs.

Retailers

→ Supply chain & fulfilment innovation

To keep up with customer expectations around fast and free delivery, deeper investment in local fulfilment networks and supply chain tech could be on the cards. However, retailers need to think carefully about when rapid delivery makes sense, as competing head on with global marketplaces may lead to significant margin erosion over time.

→ Marketplace expansion

Some retailers will continue to double down on their marketplace offerings to deliver more range and eyeballs to their site, which doesn’t only deliver sales but bolsters inventory for retail media. Whilst other retailers will actively consider the role these 3rd party marketplaces play within their broader eCommerce strategy, retailers who have built strong, widely recognised private label brands may see marketplaces as a growth channel to power further adoption and share of their private label portfolios in market.

The last word on Temu down under

Temu’s ambition is clear: it wants to be the first port of call for the value-first Australian shopper. If it continues its trajectory, it could reach 5 million active users by the end of 2025, a scale that would position it as a serious challenger to established players like Kogan and Amazon’s local operations, and fill the gap left by the decline of platforms like Catch.

Though still in relatively early days in Australia, it’s a disruptive force that is shifting consumer expectations and market dynamics at speed. Its unique model, turbocharged by affordability, convenience, and now local seller onboarding, will continue to find fertile ground amongst Australian consumers. The brands and retailers that adapt first will be best positioned to navigate the shifting landscape.